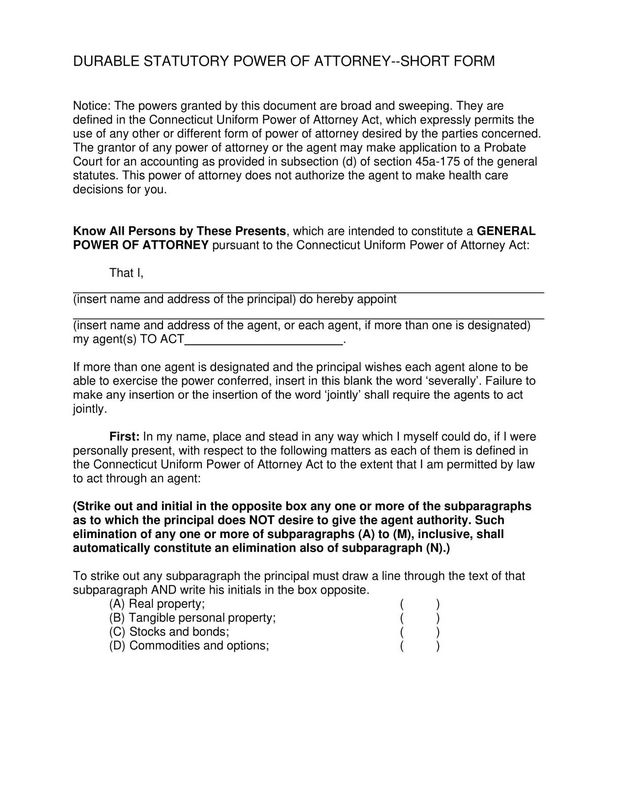

Power of Attorney in Montana (monetary)

By: Montana State College Expansion

There are Montanans that, as a result of their scenarios, might gain from having a Power of Attorney (POA). A POA is a record in which a single person provides one more individual the power to carry out particular activities on his/her part.

Introduction

There are Montanans who, as a result of their scenarios, can benefit from having a Power of Attorney (POA). A POA is a paper in which a single person offers one more individual the power to carry out specific actions on his/her behalf. Examples of scenarios in which a created POA could be useful include:

A single woman whose mommy has Alzheimer’s illness understands she would require somebody to make financial decisions if she establishes the exact same condition. An adult with a cognitive or psychiatric special needs who lives and functions separately, however needs support with monetary choices. An elderly grandma with macular degeneration desires her daughter to determine bills gotten in the mail and compose checks for them due to the fact that she can no more see. A wife and other half that want to provide each other authority to take care of funds need to either one ought to come to be incapacitated.

This short article has been adapted from the Montana State College Extension Office’s MontGuide, “Power of Attorney.” The function of this MontGuide is to give info concerning the Montana Uniform Power of Attorney Act(reliable October 1, 2011). The Act lays out stipulations for the production and use of a POA and gives safeguards that are made to shield:

The person who provides the power (principal); The person who is accredited to make decisions in behalf of the principal (representative); and, Those that are asked to count on the POA authority, such as financial institutions, businesses and various other entities.read about it Fill out West Virginia Dmv Power of Attorney from Our Articles

The MontGuide also highlights some of the threats of a POA and clarifies functions of two types that were consisted of in the Act:

Montana Statutory Power of Attorney Agent’s Accreditation regarding the Validity of Power of Attorney and Agent’s Authority Statutory kinds are offered to download and install on this site and at the MSU Extension Estate Planning internet site under the Power of Attorney MontGuide.

Why have a Power of Attorney (POA)?

With a POA a person (principal) can assign another individual (representative) to act on the major’s part. The agent can sign lawful documents when the principal is unavailable, when the primary chooses the benefit of having someone else indication, or when the major ends up being incapacitated.

Example A:

Sara (major), a homebound senior mommy that becomes perturbed and stressed when faced with financial choices, desired her child (agent) to have the authority to create checks to pay for groceries, medication and other personal things for her. Sara signed a POA to give authority for her child to do not only these types of activities, however likewise to make any other financial choices for Sara in the future.

Instance B:

Jack (principal), a Montana National Guardsman who has actually been deployed overseas, signed a POA that offers his spouse (agent) authority to offer their home. He additionally accredited her to redeem a deposit slip labelled solely in his name that will certainly get to maturation while he runs out the nation. Jack’s POA limits his other half’s actions to those 2 purchases just.

A POA document can be produced by using the legal kind described in this MontGuide or by having a lawyer prepare one. The legal form might be suitable for lots of Montanans. Nonetheless, those with complex funds or unique conditions may desire to consult with a lawyer.

What are several of the risks of a POA?

The significant danger for the principal is the possible deceit of the representative. Unfortunately, there have actually been instances of agents that showed to be unreliable and misused money belonging to the principal. And, in most cases the cash could not be recouped.

Example C:

David, a Montana National Guardsman, called his daddy as agent in a POA before he was deployed overseas. David’s pay was deposited in a savings account that his papa might access under the POA. Unknown to David his daddy had a gambling addiction and shed every one of his personal funds, as well as all of the money in David’s interest-bearing account. David did not find his daddy’s abuse of the funds up until he went back to Montana a year later. Although David can have gone to court in an attempt to recover his money, he picked not to do so due to the fact that he didn’t want to sue his very own daddy. He likewise recognized there were no possessions to be recuperated because his dad gambled away whatever.

Instance D:

Marlene, an elderly widow, got in touch with an attorney to compose a POA naming her niece, Beth, as agent. The lawyer asked Marlene why she felt she required a POA at this moment in her life. He additionally asked Marlene concerning her connection with her niece. He encouraged Marlene of the threat that Beth could abuse her properties. Marlene chose her risk of future incapacity outweighed the threat that her niece might misuse the POA. 6 months after the POA was signed, Marlene discovered her supplies and bonds had actually been offered by her niece. Beth made use of Marlene’s cash for her personal use. Although Marlene might sue her niece, she would certainly recover absolutely nothing since Beth had no properties.

That should be named as representative in a POA?

Only the principal can choose who ought to act as agent. The person needs to be somebody the major trusts to satisfy the obligations mentioned in the POA. An agent does not have to be a loved one. The principal must prevent calling someone that is ill, a person who has difficulty taking care of cash, or someone that is unskilled in financial issues.

What are the duties of an agent?

The principal needs to notify the representative what authority (often called a power) has been given up the POA record and make sure that the representative comprehends what actions can be taken. The conversation should also consist of an explanation of the major’s financial rate of interests and exactly how the capacity choices of the representative can impact those interests.

The Montana Uniform POA Act details the representative’s duties and certain authority. Added details can be located in the Montana Code Annotated § 72-31-301 through § 72-31-367.

The Montana Statutory POA act likewise includes a section, Important Information for Representative, describing several of the agent’s duties and circumstances for discontinuation of the representative’s authority. The section likewise knows concerning prospective liability for any type of losses triggered by the agent’s offenses of the Montana Attire POA Act, consisting of any actions taken outside the authority offered by the principal. The principal needs to ask whether the agent is willing to assume the tasks and liabilities as detailed in the Montana Attire POA Act.

What decisions can an agent make on the principal’s

part? The primary decides what activities can be taken by the agent. The legal kind within the Montana Uniform POA Act provides a listing of deal categories that can be consisted of in the representative’s general authority:

- Real estate;

- Tangible personal effects;

- Supplies and bonds;

- Assets and choices;

- Banks and various other financial institutions;

- Procedure of entity or service;

- Insurance coverage and annuities;

- Estates, counts on, and various other beneficial interests;

- Cases and lawsuits;

- Personal and family maintenance;

- Gain from government programs, civil or armed forces solution;

- Retirement plans; and

- Taxes.

What added decision-making authority can be provided to an agent in a POA?

The Montana Attire POA Act notes specific activities the representative can take, however just if the principal particularly states the powers in the POA. The principal must thoroughly take into consideration whether the additional powers below ought to be given to a representative as they might substantially impact the principal’s estate plan.

- Produce, modify, revoke, or terminate a revocable living depend on;

- Make a present;

- Create or alter civil liberties of survivorship;

- Create or change a beneficiary designation;

- Waive the principal’s right to be a beneficiary of a joint and survivor annuity; including a survivor benefit under a retirement plan; or

- Disclaim property.

Nevertheless, an agent is not permitted to create a will for a principal. Neither can a representative use POA authority to directly represent the principal in court.

- Uncategorized

- Lorem Ipsum

- Lorem Ipsum Dummy Text

- Lorem Ipsum Dummy

- blog

- ! Без рубрики

- 1

- Pablic

- NEW

- sep_mars_innovationforum_hopscotchfriday

- sep1

- sep2

- sep9

- Forex News

- test

- aug_bh

- sep_pb_realbusinesscommerce.com

- oct2

- oct1

- a16z generative ai

- sep

- sep+

- casino241

- Bookkeeping

- casino242

- casino25

- casino27

- Public

- Новости Форекс

- chat bot names 4

- ready_text

- Casino

- Omegle

- aug_ch_1

- Sober living

- Bookkeeping

- bildungsinstitut-reittherapie.de

- beste-zahlungsarten.de

- httpswww.comchay.de

- Monro-casino

- httpswww.hermannhirsch.com

- Betory Casino

- marktkauf-shs.de

- Our online casino partners

- oct_airrightheatingandcooling.com

- danbigras.ru

- mbdou-18-41.ru

- selektor5.xyz

- jur-expert.ru

- domovar-shop.ru

- pulmix.ru 10

- winxschool.ru

- mokuloy.ru

- bezflash.ruluchshie-onlayn-kazino 10 20

- dream-air.ru 150

- 5trucks.ru

- ihnk.ru

- slfmsal.ru 20 30

- Omegle cc

- CH

- EC

- CIB

- Buy Semaglutide

- pryazhaschool.ru 150

- Новая папка (5)

- vsenichego.ru

- news

- pirs67.ru 10

- greekgirlscode.com

- developmentspb.ru 10

- bezopasnyirepost.com

- luckhome.ru

- bazageroev.ru

- imageloop.ru

- oren-ldpr.ru

- gamerellato.hu2

- edosszie.hu2

- veganhealth.ru

- 515santacruz.com2

- super-rewrite.1760423110 (1)

- sep_pb_americanwritersassociation

- reutovo.ru

- 1bet5

- cityoflondonmile3

- VulkanRoyal

- дс152ржд.рф

- 2

- 3

- 4

- 5

- 6

- aromeconte.ru

- ES

- selector7.xyz

- Affiliate

- Semaglutide Online

- trygge-norske-casino

- Forex Trading

- casino1

- Buy Semaglutide Online

- gel-school-10.ru

- logic-avto.ru

- vodkacasino.biz

- casino2

- 1xbet1

- 20

- betwinner1

- casino3

- BETMAZE

- bet1

- articles

- icestupa8

- biboshop.ru

- remont-adriatica.ru

- icestupa9

- sdmcenter.ru

- iptaletmek.net

- icestupa10

- korova33.ru

- NL

- etopechen.ru

- Online Casino

- Мостбет

- 7

- bet2

- 1xbet2

- latrendo.ru

- Форекс Брокеры

- gdouuds.ru

- remont-certina.ru

- ceramicx.hu

- icestupa13

- uhm.hu

- IT

- Текста

- matecafe.ru

- pokerokgames.ru

- 111

- pdrc

- pocketoption1

- bcgame1

- primexbt1

- Sober Living

- casino4

- bcgame2

- casino5

- 1xbet3231025

- primexbt3

- Up X

- games for money

- casino7

- xn--17-8kc3bfr2e.xn--p1ai 36

- super-rewrite.1761573995

- casino en ligne part1

- bcgame3

- traiding1

- igry-nardy.ru 4-8

- no kyc online casinos

- online casino real money usa

- online-casino-simplelifewinery

- okwin

- mininformrd.ru 4-8

- rusolidarnost.ru

- EN

- bcg4

- казино up x

- 99h.in

- Up X casino

- www.strana-sadov.ru 5

- Texs

- Pin-Up indir

- aug_ch_2

- Pin-Up oyunu

- oren-ldpr.ru 20

- no kyc casinos

- servishizmetisorgula.com

- Pin-UP VCH

- traiding4

- betting2

- oct_pb_thenailluxury.com

- Pin-Up yukle

- digitaleconomy.world 100

- trading5

- propulsion2012.com 20

- vavada11.store

- bezopasnyirepost.com 20

- pelet-srbija.net2

- Pin-Up AZ

- artofourcentury.com

- trading6

- stoneoakpilates.com

- casino8

- digilitleic.com

- littlebrothereli.com2

- Новини

- trading8

- ori9infarm.com

- casinobet1

- hudsonwestnyc.com3

- hipresurfacingindia.com2

- ufmsra.ru 20

- ð¥ð¢ð╗ð░ð©╠åð¢ ð║ð░ðÀð©ð¢ð¥ ð┐ð¥ð╗ÐîÐêð░

- rosomed2020.ru 20

- Generated

- best online casino32

- spasateli44.ru 4-8

- oct

- 7Slots

- 1win-apk.ci

- bc-game-ng.ng2

- bating9

- montecryptoscasinos.com

- ekaterina-school.ru 4-8

- okrogslovenije

- le-bandit-casino.comde

- felix-tropf

- best online casino

- farmacia2

- ortokonovalov.ru 4-8

- bet3

- oct_pb

- oct_bh

- trader10

- vulkn.ink

- bou-sosh6.ru 36

- bou-sosh6.ru 4-8

- 1k

- australianationalday.com x

- edu-alania.ru 120

- farma3

- trading11

- jaya92

- bet4

- diplomasedy

- vrclub-tron.ru 4-8

- hitnspinofficial.ch

- boomerangcasino.ch

- zotabetcasino.ch

- billybets.ch

- mrpachocasino.ch

- ggbetofficial.de

- 1betcasino.de

- betonredofficial.com

- mobilapplikacio.com

- r7csn.pro

- r7csn.click

- diplomm-i

- r7csn.xyz

- federalisme2017.ch

- faustacapaul.ch

- apoteket4

- schauspielschule-basel.ch

- schanfigg-tourismus.ch

- kursk-school33.ru 4-8

- bmcracingcup.ch

- eintracht-hermatswil.ch

- festivaljahr.ch

- diplomroomss

- Pin-Up UZ

- trading12

- LotoClub1

- nov1

- gsdiplom

- casinonon1

- fc-metallurg.ru 50

- 6irgpv63wp

- bf061h2us3

- dwtlwwlyfb

- fywui40eus

- k45mkbfgwl

- ovpbvi9ssg

- zd07kvuuto

- kshhaveservice.dk

- www.sarkparishchurch.org.ukhorse-racing-betting-apps x3

- aabt8xjfso

- efagt7h0zu

- jf6vpy21c1

- u1b0jemc2p

- 11

- nov_tenig.com

- trading13

- nov_katymanorapartments.com

- casino6

- l70auvdo6y

- www.woodcodemocrats.org x3

- trading14

- scommesse1

- trading15

- adobe generative ai 2

- casino-en-ligne

- 13

- 19

- 25

- 31

- 37

- 42

- 43

- 45

- 50

- 53

- 61

- 64

- 70

- 73

- bauhutte-g.com

- 77

- 82

- 86

- 91

- 97

- 101

- casino19

- 1xbet3

- yjacademy.in3

- trading16

- casino en ligne suisse

- roobetitaly.it

- 22betwetten.de

- unibetaustria.at

- interwettenaustria.at

- rabonaonline.de

- hindilanguage.info x

- Jetton Casino

- uj-kaszinok.edenivegan.hu

- casino en ligne international

- ballybet usa

- Pin-Up TR

- dsfgsdg

- casino en ligne suisse legal

- bezflash.runovye-onlayn-kazino 5

- ltrading17

- podberi-monitor.ru 36

- casino10

- casino20

- 1xbet4

- ogbuzigp17irk.ru

- ufacity-sport.ru

- 4122

- aquinascenterphilly.org2

- roof-trade.ru 50

- casino11

- 1winmd.com

- diplomsvuz

- casino21

- aliexpressofficial.com

- xn--b1ahokatpb.xn--p1ai 5

- fitago.ru 15

- up-x-on-15590-55

- spacesports.rufrispiny-za-registraciu 20

- casino12

- casino22

- googlepay

- r7cs.vip

- r7cs.club

- r7cs.info

- Jojobet

- sushi 6

- kvatroplus.ru

- casino13

- engelsegoksites

- n1interactivecasinos

- Partners

- medisource.ru

- billybets.at

- betonred-casino.at

- bet-on-red-casino.at

- billybets-casino.at

- ethereum

- plabel.ru

- kinbet-casino.at

- brucebet.at

- brucebet-casino.at

- allyspin-casino.at

- bassbet-bonus.at

- casino-15-11-1

- casino14

- Pars

- gde-mrt.ru

- polskiekasyno

- bass-bet-casino.at

- 10eurodeposit

- rsem.pro

- r7csn.club

- evilinside.ru 2

- ancorallZ 15000

- oct_pb_campingunplugged.com

- xn--80abb7abvqcgh3c0dtbg.xn--p1ai

- casino-17-11-1

- casino16

- aze-1xbet

- msgbc2021

- bleskuborka.ru 2

- bookmakerszondercruks

- sredstvo-klopov.ru

- valentina-bondareva.ru

- Pinco TR

- majomadigital.com.ar

- rohiplant.com

- casino17

- casino26

- r7csn.lol

- r7csn.onl

- coffeepotmag.ru

- mybrtracing

- chrstark.com

- nobullchallenge

- autodilerspb.ru 2000

- bedwinner1

- tmebonuspokerdom

- uncategorized

- casinobet2

- t.mesriobetcasino_official 3000

- kampo-view.com

- tmepokerpokerdom

- armynow.net

- casino18

- bitwinner2

- scca.hr

- naudapay1

- t.mesriobet_zerkalo_na_segodnya 3000

- magyarszerzokkonyveimagazin.hu

- izidopotpora.hr

- temeljnidohodak.hr

- d

- fr 150

- mireillelebel.de

- patria-residenzen.de

- antikaeltehilfe.de

- thomas-petandfamily.de

- caritaeter.de

- t.meriobet_promocod 3000

- medzinárodné kasína

- casino30

- chefi.gr

- casino28

- pin-up-bonus

- az-melbet

- azpinupcasino

- online casino paysafecard

- t.mesofficial_site_pokerdom 3000

- onlinecasinomonobrands

- netprofessional.ru

- Credit Card Casino

- Games

- casinobet3

- saleslatitude.com2

- showbet 4860

- t.meofficial_site_pokerdom 3000

- loschmanagement.com x3

- casino-20-11-1

- casino29

- betwinner2

- newenglandgrows.org

- braintreerec.com3

- casinobet4

- andreschweighofer.com

- primexbt2

- debtech.hu

- vodka-online.ru

- omneex.ru 300

- pin-up-az-casino

- mostbet-registration-az

- aze-mostbet

- albania2025

- Turkie Casino

- no kyc casino

- chickenroad

- tmoktato.hu

- yiannismakridakis.gr

- mostbet nov 5160 (2)

- www.fonddrug.ruevent 300

- showbet 8400

- Lev

- sos-hamburgdog.de

- awo-selb.de

- barceloneta-dresden.de

- wings-apart.ru

- ymk-mebel.ru

- betwinner3

- mostbet2

- digitalgmu.ru 2000

- Non GamStop

- www.alapbibl.ru 300

- Eldorado 1

- kvintessenciya-zhizni.ru

- Eldorado 2

- xn----7sbbilrebpcpc3azcfbs.xn--p1ai

- Klubnika

- nov2

- bahisyasal 8000

- nov_lod+wd+sb

- showbet 4860 (2)

- cinschool.in x1

- bohopanna.ru 500

- Porn1

- interactive-bin.mk

- Supabet

- cashlib

- kazan99.ru 1000

- mostbet3

- ristorantelimoncello.hu

- tangyra.ru 2

- crypto casino

- nov_pb_chez-monia.com

- krsosh.ru 1000

- betandreas2

- pocketoption2

- mcmagistral.ru 500

- Pinup kz

- trafficjam-2024.ru 500

- Pinup kz 1

- betcasino4

- restaurantelacontrasena.com_casino-sin-verificacion

- restaurantelacontrasena.com_casinos-online-extranjeros

- zdravstvo24.mk

- imiks-light.ru

- bitcoin casino schweiz

- kaskad-estate.ru

- 1xbet-online-casino.com

- idezetekkonyve.hu

- daem-vzaem.ru

- casino-25-11-1

- melbet-online-casino.com

- Pinup kz 2

- sindinero.org_casino-online-europa

- pinup-online-casino.org

- betandreas3

- sindinero.org_nuevo-casino-online-espana

- levkzcascading

- szakmaicegkereso.hu

- sep_pb_brianscarnivorous.com

- nov5

- nov_az

- 1xbet-online-casino.comuz

- casino en ligne fiable

- meilleur casino en ligne

- xn--46-6kc8bnagjfo4b.xn--p1ai 2000

- Post

- iskra-guitars.ru

- nov_troyandlindsey.com

- pocketoption3

- wekerlekos.hu

- nov_bh_untamedboxingfitness.com

- nov_sarosdanenerede.com

- somoslux.com.ar x3

- sushi 11.2

- jbcasino2

- casino-sin-licencia

- sheesh casino

- новости

- eldowinteractive

- lovestitched.com

- Health

- Adult

- ds93-ukhta.ru 700

- kompastk.ru 300

- Invest

- megapari.ph3

- megaparicameroun.com3

- bahistasal nov 6028

- bt prod 3810

- nov3

- casino01-12-1

- bt prod 3810 (2)

- xn-----6kceg1bcikd2aeqnpkca2q9b.xn--p1ai

- phonebazis2

- wildsinocasino.ch

- bwinbet.ch

- bitkingz.ch

- bashhoney.ru 700

- aurgazeta.ru

- what does nlu mean 8

- gamblezen.ch

- kazino2

- casono02123

- dec_nicebabylife.com

- greatgames.com.cy

- curiumpalacehotel.com.cy

- sovetinskoe-sp.ru

- morozovskobr.ru

- pricepblog.ru 4-8

- smartline93.ru 240

- mnogo-tv.ru

- kzto-zavod.ru

- Mix Casino2

- nf-p.ru

- mebelitaly64.ru

- Mix Casino3

- vodka-zerkalo.ru 5

- vodka-casino-skachat.ru 5

- safaritoy.ru

- Mix Casino11

- vodka-casino-oficialnyy-sayt.ru 5

- nov_turismocomunidadvalenciana

- jos-trust

- heame.ru

- referatius.ru

- casinobet5

- Mostbet

- Trading

- www.boutiquesagefolie.com z

- tmespokerdom_kak_igrat

- dec_bh_common

- dec_pb_common

- oct_pb_fintechworldcup

- bestdiplomsa.com

- casinobet6

- Spain Casino1

- Mostbet 2

- yukselimokullari.com

- Netherlands Casino2

- pokerok-club.lol

- pokerok-bonus.click

- nov_sp+gof

- Mostbet 3

- nov_psikoturk

- casinobet8

- somoslux.com.ar z3

- edudiplomsa

- casinobet10

- gosz-diplomas

- kaszino

- 2. salzburg2016.at

- iddog.ru 300

- 1. wienwin.at

- 5. nobelvienna.at

- 3.lafotografadeigatti

- 4.tavoliexpo

- 5.agorascienza

- 6. bauliinpiazza

- online-casino.wekerlekos.hu

- fiestaklub.hu

- nov4

- femicid.ru 20

- fortboyard.online 20

- 29. youngheroes.at

- digitaleconomy.world 20

- standwithukrainetour.com 20

- 07. zukunftsmusik.fm

- Blog

- ladish.ru

- 08. goldstueck-vienna.at

- 13. richard-seeber.at

- Belatice CZ

- Australia Casino1

- avshcherbina.ru

- casinobet14

- www.sv-hillebrandt.de

- nov_bh_estrazioni.org

- edutatar.ru 10

- Indonesia Casino1

- hindistories.in z

- casinobet15

- Indonesia Casino2

- eye-of-horus-slot-online.com

- casinoslot1

- 1xbet5

- meilleurs casino en ligne

- casinobet16

- Jetton

- 1xbet6

- tamaradelempicka.es

- alemania-turismo.com

- atlantikcorner.com

- tedt c

- x4games.ru 4-8

- Indonesia Casino

- kazan99.ru

- xn----7sbhgohjfczfmcigz7a6l.xn--p1ai

- krigerindia.com2

- veltramo.xyz

- lawrencenko.ru 1

- casinobet18

- sintai74.ru 4-8

- feelyourbody.ru 4-8

- xn----gtbaf9aqim9gn.xn--p1ai

- pin-up-bd.net z1

- sch2kr.ru 4-8

- voddscasino

- thebackpackers.net

- softegypt.org

- casinobet20

- vodds1

- www.thefearfactory.co.uk z

- Новая папка (2)

- Новая папка

- casinobet21

- websitepromotion2

- illuminatethebike.com z

- www.steiko.ru

- lebandit-online.com

- fortune-rabbit-demo-online.com

- websitepromotion3

- lampohouse.ru 20

- imageloop.ru 20

- volgambk.media 20

- bancorallZ 1500

- mostbet 1 3100

- Nomad

- casinobet24

- 1xslots-zerkalo-skachat.ru 4-8, 10

- daavdeev.ru 4-8

- 1xslots-bonuskod-zerkalo.ru 120

- casinobet25

- 1xslots-vhod-android.ru 4-8, 10

- 1xslots-skachat-android.ru 4-8, 10

- nartanyapi.com

- 20betaustria.at

- helpwithbowling.com z

- casino francais en ligne

- beautypalacebahcesehir.com

- villaparkgelibolu.com

- hkb-jazz.ch

- casinobet26

- joy-in-iran.de

- sv-moslesfehn.de

- fotostudio-finkler.de

- independentcommissionfees

- 1xslots-oficialniy-bonuskod.ru 4-8, 10

- 1xslots-android-skachat.ru 4-8, 10

- 1xslots-android-skachat.ru 120

- 1xslots-oficialniy-bonuskod.ru 120

- 1xslots-oficialnyy-vhod.ru 4-8, 10

- casinobet27

- mvclinic.ru 10

- pryazhaschool.ru 10

- yesilmutabakathaber.com

- gyors-kifizeto-kaszinok

- magyar-online-casino

- 1casino

- risetechsol.com

- logosstudy.ru 10

- fixprice-katalog.ru 10

- fixprice-katalog.ru 50

- teknolojidevi.net

- onlinecasino1

- nov_aseofsa.com

- magyar-online-kaszino.turania.hu

- nov_austinburgtruckcenter.com

- Микрокредит

- otzivorgt.ru 10

- loviden.ru 10

- 2casino

- Pinco

- showbet 2 3600

- tutbonus.ru

- Pinco 1

- kevseriklimlendirme.com

- vanuatucbi

- agro-code.ru

- casinobet29

- Pinco 2

- 10

- Pinco 3

- Новая папка (3)

- xn--1010-6kcyk1d2d.xn--p1ai 10

- bcg3

- Pinco 4

- casinobet30

- najbardziej wyplacalne kasyno

- Pinco 5

- Casinoly casino

- comregras.com z

- casinojaya9

- resto-elephant.com

- Pinco 6

- 1xbetindonesia.site

- casinobet32

- casinoslot3

- www.aqaratko.com z

- www.oxywell-tec.de

- dvdfutar.hu

- www.turania.hu

- www.edenivegan.hu

- bcgame4

- bookmakers1

- historyrusedu.ru

- casinoslot5

- www.ertekesitoallas.hu

- cityoflondonmile1

- mi-faq.ru

- endustriyelmutfaks.com

- tenisz-palya.hu

- www.wekerlekos.hu

- rezume2016.ru 50

- servisimkocaeli.com

- siti-scommesse2

- fivemturkiye.net

- renkderyasi.com

- nov7

- cityoflondonmile2

- agricoyatirim.com

- Vaycasino

- beregaevo.runews 4-8

- beregaevo.ru 36

- 1Win AZ

- xn----htbdjdogytnf3i.xn--p1ai

- jandjequestriancenter.com z2

- timasderi.com

- okplaypoker.pro

- ok4poker.club

- www.dataloggers.in z

- mostbet1

- 1win tr

- karabaglarotoekspertiz.com

- Unsere Partner

- Casino DE

- 1Win

- Mostbet AZ

- casinos nl

- betcasino1

- betcasino2

- betandres4

- mostbet4

- mcworld.mobi z3

- NonGamStopCasinos

- gofastfords.com z

- melbetbdapp.comen-bdmobile-app z2

- Новая папка (4)

- ctic.in z

- Новая папка (7)

- elitlifekuaforguzellik.com

- drguzellik.com

- labdarugas.cimpa.hu

- Alev casino tr

- casinoonline2

- spasateli44.ru 36

- mbousosh10.ru 36

- spu30.ru 36

- b2500

- b2550

- 400Z

- carone.in z2

- betcasino5

- ekaterina-school.ru 120

- Новая папка (13)

- 1xslots-oficialnyy-vhod.ru 36

- betcasino6

- 1xslots-vhod.ru 120

- 1xslots-oficialnyy-sayt.ru 36

- kale71.com

- kiliclarhirdavat.com

- USA Steroids

- 8

- etap43rentacar.com

- onlinecasino2

- joya93

- onlinecasinoslot2

- hobilove.com 1000

- biyoenerjiuzmani.com 1000

- casino12251

- slotcasini1

- onlinecasinoslot3

- onlinecasinoslot4

- 3Mostbet

- casinocz1

- onlinecasinoslot5

- 1xbet7

- 4Mostbet

- 2. ottocasinoonline.com (можно прогонять)

- 5. momangofficial.com (можно прогонять)

- kungaslottetofficial.com - kungaslottet

- kungaslottetsverige.se - kungaslottet

- dec_39kfood

- bahisyasal 4521

- cherrycasinosverige.se - cherry casino

- comeonsverige.se - comeon casino

- Новая папка (6)

- casino01264

- 1xbet8

- 5Mostbet

- ipho

- casumoofficial.com - casumo

- onlinecasinoslot7

- casino01265

- 1xbet9

- casino01266

- kasyno online wyplacalne

- 1xbet11

- onlinecasinoslot8

- 1xbet12

- onlinecasinoslot9

- ricardoveron-afrodizyakparfumu.com

- 9Mostbet

- roof-trade.ru 240

- keflibicak.com

- fortune-tiger-demo-online.comvi

- beste casino boni schweiz

- casino online suisse legal

- Casinoly

- onlinecasinoslot10

- sophiacollege.in4

- elon 2

- 10Mostbet

- sunaonal.com 1000

- beyazbuket.com 1000

- haliyikamamiss.com 1000

- casinoslot4

- bilgenoniz.com 1000

- onlinecasinoslot11

- bizzocasino.hu

- www.ticketleap.eventsticketsyedoveraingyen-porgetes-befizetes-nelkul-hol-erheto-el-valodi-ajanlat

- diplomm-i3

- biyskmedspo.ru

- marketasdiplomas1

- casino en ligne

- onlinecasinoslot12

- diplomrums1

- 12Mostbet

- egu-diplom1

- diplomrums2

- quebecozclub.com

- onlinecasinoslot13

- gosz-diplomas1

- diplomrums3

- rezume2016.ru 240

- marketasdiplomas3

- gosz-diplomas2

- egu-diplom2

- aquacitysuit.com 1000

- onlinecasinoslot15

- Vietnam Casino1

- Nasi Partnerzy

- omerlh.info

- gosz-diplomas3

- auto-werkstatt-nuernberg.de

- www.medizinrecht-ratgeber.de

- www.vergaberecht-ratgeber.de

- logosstudy.ru 150

- onlinecasinoslot16

- risetechsol.com 1000

- Vietnam Casino2

- otzivorgt.ru 150

- loviden.ru 150

- businessfoxesacademy.com

- pokerdom.xn--90afbbc8aejlj1a2jfyv.xn--p1ai 10

- deeprockgalactic.ru 10

- pinup-kazino-kz.top

- Our Partners

- balertoptantisort.com 1000

- onlinecasinoslot17

- gosz-diplomas5

- tuzergayrimenkul.net

- onlinecasinoslot18

- gosz-diplomas6

- 1win-bet.br.com

- onlinecasinoslot19

- isyerihemsireligi.com 1000

- antsaat.com 1000

- onlinecasinoslot20

- uzmankombiservisim.com 1000

- casino en ligne francais

- Общак

- eykrentacar.com 1000

- onlinecasinoslot22

- xn--en-kazanl-slot-oyunlar-66b19ona.ne

- Canada Casino1

- korsantaksiduragi.com

- meilleur casino en ligne france

- Strategy

- batikentcicekci.com 1000

- pinup-kazino-login.top

- English Casino

- mehmetustatatlilari.com 1000

- Socializing

- mehmetustasalca.com 1000

- cl.1win-chile.cldescargar-aplicacion x1

- onlinecasinoslot23

- bettingcasino4

- Alexander Casino 44

- pinup-official-kz.top 3

- poliklinika4rm.ru 10

- selust.com 1000

- 1winkazino-az.com

- ozkardesleryapi.com 1000

- www.camping-adventure.eu

- bettingcasino5

- tanismanticaret.com 1000

- Nine Casino Polska

- www.badacsony200.hu

- English Casino11

- gordostnation.ru 10

- www.technosport.hu

- tuzergayrimenkul.net 1000

- www.lakas1x1.hu

- English Casino22

- skovorodkaclub.ru 10

- jan_pb_mkeschoolmap.org

- www.piccolatoscanapecs.hu

- onlinecasinoslot25

- www.theindianleague.in x

- Alexander Casino fr 2

- vinoora.ru 10

- surdurulebilirliksertifikasi.com 1000

- casino140126

- lesparksad.ru 10

- onlinecasinoslot26

- cinarehliyet.com 1000

- nastolki18.ru 10

- xn--ok-kazandran-slot-oyunlar-sgc12rqa.net 1000

- bedava-slot-oyna.org 1000 (2)

- my-busines.ru 10

- dream-air.ru 10

- Pin-up KZ

- www.bamboology.in x

- xn--kazandran-slot-bgc.net 1000

- projectinblue.com 1000

- onlinecasino1401

- onlinecasinoslot27

- scalesmoundfire.org x

- t.meselector_official_ru 2

- hostel-dachny.ru 1000

- onlinecasinoslot28

- t.meselector_casino_zerkalo

- para-veren-siteler.com 1000 (2)

- freebet-veren-siteler.com 1000 (2)

- t.meriobet_promocod 2

- jan4

- jan6

- gsmbccovington.org x2

- jan2

- gates-of-olympus-oyna-demo.com 1000 (2)

- sweet-bonanza-demo-oyna.org 1000 (2)

- onlinecasinoslot29

- betcasino3

- xn--para-kazandiran-ans-oyunlar-nce63k.net

- casino1601

- t.meriobet_zerkalo_na_segodnya 2

- winterengel.com2

- www.ibecomi.net x2

- casino16011

- t.meriobetcasino_official 2

- pawanthevacationexpert.in

- onlinecasinoslot31

- vodds

- betify casino

- betlive casino en ligne

- betlive casino en ligne 2

- onlinecasinoslot32

- casino17011

- betcasino1701

- onlinecasinoslot33

- casino extra

- casinoudenrofus

- mahagacor77id.com

- casino-vip.cl x

- drinkchicagostyle.com2

- onlinecasinoslot34